Though the justice’s brief order gave no reasons, it was most likely based on the challenger’s seeming failure to show that it had standing to sue.

-

Send any friend a story

As a subscriber, you have “>10 gift articles to give each month. Anyone can read what you share.

Give this articleGive this articleGive this article

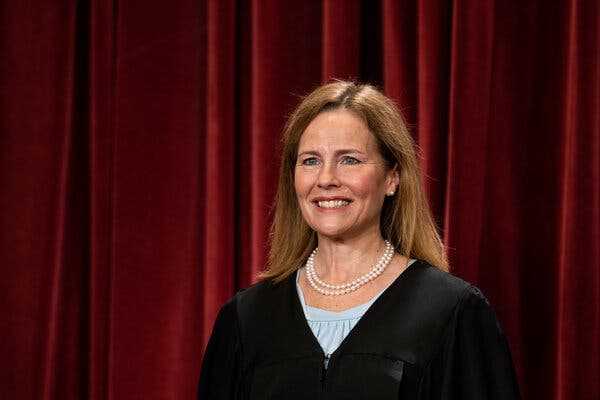

Justice Amy Coney Barrett oversees the appeals circuit court that ruled against a Wisconsin taxpayers’ association in the case.

WASHINGTON — Justice Amy Coney Barrett on Thursday rejected a challenge to President Biden’s student debt relief program from a taxpayers’ association in Wisconsin that said he had overstepped his authority in adopting the sweeping measure, one that could cost the government hundreds of billions of dollars.

Justice Barrett denied the association’s challenge without comment, which is the court’s custom in ruling on emergency applications. She acted on her own, without referring the application to the full court, and she did not ask the administration for a response. Both of those moves were indications that the application was not on solid legal footing.

Although she did not say so, Justice Barrett most likely rejected the application because the plaintiff, the Brown County Taxpayers Association, did not appear to have shown that it had suffered a direct injury that gave it standing to sue.

The association argued that Mr. Biden had exceeded his authority under a 2003 federal law that allows the education secretary to modify financial assistance programs for students “in connection with a war or other military operation or national emergency.”

The plan cancels $10,000 in debt for those earning less than $125,000 per year and $20,000 for those who had received Pell grants for low-income families. The nonpartisan Congressional Budget Office said last month that it estimated the plan’s price tag at $400 billion. White House officials have said that the cost could be lower because fewer borrowers than expected might apply for the relief.

More on Student Loan Debt Relief

- A Legal Challenge: Six Republican-led states have filed a lawsuit to block President Biden’s student loan forgiveness plan, accusing him of vastly overstepping his authority.

- The Plan’s Price Tag: Mr. Biden’s plan could cost about $400 billion, the nonpartisan Congressional Budget Office said, making it one of the costliest programs in the president’s agenda.

- A Hard Sell: At the White House and aboard Air Force One, advocates of debt cancellation made a sustained push to win over Mr. Biden. Here’s how he finally gave in.

- Who Will Benefit?: The big winners from Mr. Biden’s plan are not rich graduates of Harvard and Yale, as many critics claim. It’s the middle class — and disproportionately young and Black people.

Judge William C. Griesbach of the Federal District Court in Green Bay, Wis., dismissed the case without addressing whether Mr. Biden had acted lawfully. Instead, Judge Griesbach, who was appointed by President George W. Bush, ruled that the association had failed to show that it had standing to sue.

The Supreme Court has said that the mere payment of taxes does not give plaintiffs standing to challenge government programs. “If every federal taxpayer could sue to challenge any government expenditure, the federal courts would cease to function as courts of law and would be cast in the role of general complaint bureaus,” Justice Samuel A. Alito Jr. wrote in 2007.

The court has carved out a narrow exception for some religious challenges, though Judge Griesbach noted that even that exception “has been the subject of much criticism.”

He rejected the group’s request to expand the exception to allow the challenge to the student loan program. “This court certainly has no authority to do so,” he wrote.

Judge Griesbach also questioned whether an injunction stopping the program would be warranted even if the challenger had standing. If the administration acted unlawfully, he wrote, people who obtain debt relief might again be liable for forgiven debts.

“A future administration may not be bound” by the Biden administration’s program, the judge wrote, “and may seek to collect the purportedly forgiven debts.” Judge Griesbach added that “those seeking to take advantage of the program” may want “to consider this possibility before placing undue reliance on the benefits promised.”

A three-judge panel of the U.S. Court of Appeals for the Seventh Circuit, in Chicago, refused to intervene in an unsigned order that gave no reasons. Justice Barrett oversees that circuit, and emergency applications concerning its rulings are addressed to her in the first instance.

In its application, the association argued that the sums involved warranted loosening the standing rules. “We are witnessing a gargantuan increase in the national debt accomplished by a complete disregard for limitations on the constitutional spending authority,” the association’s lawyers wrote.

They added: “The argument that a president may unilaterally forgive debt owed to the U.S. Treasury through executive fiat, and that no one has standing to challenge him, threatens the very foundations of a constitutional republic.”

Source: nytimes.com