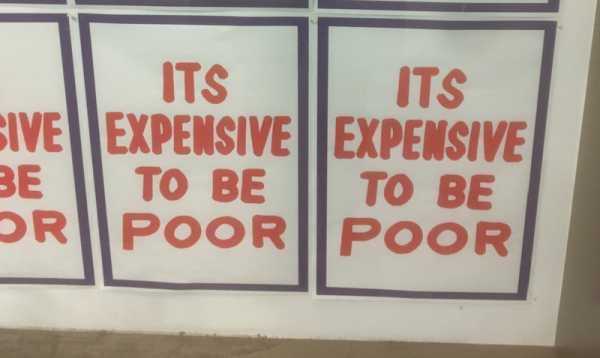

It is never too late to do the right thing and stop austerity 2.0. (Photo: Matt Tempest)

“A week is a long time in politics,” a British prime minister once quipped during his country’s crises of the 1960s. But even a savvy and experienced statesman like PM Harold Wilson would have been left stunned by the recent volte face performed by European policymakers.

In the space of just six hours, let alone seven days, they had both celebrated the positive impact of increased public investment and voted to severely cut it.

The revealing series of events began at 11am last Wednesday (21 February) with the publication of the European Commission’s mid-point evaluation of its Recovery and Resilience Facility (RRF).

It set out how the €225bn investment made so far has led to stronger economic growth, record low unemployment and been a “considerable boost” to the green transition.

“We have seen funding for energy efficiency, renewable energy and digitalisation projects like never before,” said EU Commission president Ursula von der Leyen.

Anyone reading it could have been left in no doubt that increasing public investment was positive and supported by the EU.

Yet, at 5pm on the same day, the European Council approved new economic governance rules which would place severe limits on future public investment.

The rules, which were proposed by the commission and made even more severe by the council, would require member states to reduce their deficits to 1.5 percent of GDP.

That would force member states to collectively cut their budgets by more than €100bn in the first year of their implementation alone.

France (€26bn), Italy (€25bn), Spain (€14bn), Germany (€11bn), Belgium (€8bn) and the Netherlands (€6bn) would have to make the biggest annual cuts to meet the deficit reduction targets within four years.

The only pain relief open to member states is to spread the pain over seven years — but even then that would only be possible in exchange for commitments, such as anti-worker economic reforms.

Exactly the wrong policy, at the wrong time

The result of these rules would undoubtedly be weaker economic growth, higher unemployment and a blow to the green transition — the opposite of what the RFF has achieved — with no hope of a just transition built on quality jobs.

Private sector investment has already fallen by five percent since the pandemic. Profits have been siphoned-off in record dividend payments, but the European Central Bank’s decision to raise record interest rates to record levels has also played an important role in killing investment.

Against this background, cutting public investment would all but guarantee another recession.

It would also badly compromise the EU’s social and climate objectives.

Sign up for EUobserver’s daily newsletter

All the stories we publish, sent at 7.30 AM.

By signing up, you agree to our Terms of Use and Privacy Policy.

Economic think-tank Bruegel joined trade unions in calling on policymakers to ensure that spending needed to meet the EU’s own social and climate targets was not made impossible by the rules. Our calls were not heeded.

It means that, under the rules, just four member states would be able to make the investments needed to meet the EU’s climate commitment, according to research by the New Economics Foundation.

The coincidental timing of the adoption of these rules proved that policy is being made on the basis of political dogma and not what is working in practice.

Quality jobs, a green economy and a fairer society is being sacrificed to satisfy spreadsheet economics. The EU’s own analysis has made it clear this is economic self-sabotage.

It is also politically foolish three months from an election in which the far-right are predicted to increase their support.

The last dose of EU-mandated austerity made a significant contribution to the rise of the far-right across Europe, recent academic research found.

It is never too late to do the right thing and stop austerity 2.0.

But at very least the EU must surely make sure that, if it is going to drastically cut the investment capacity of member states, then its own programme of investment continues.

The RFF, which was established to limit the economic fallout of the pandemic, is set to end in just two years’ time.

It must be replaced with a new and permanent EU investment instrument to ensure that at least once source of public investment is still open.

Member states also need to bite the bullet and increase taxation rates of the richest individuals.

Otherwise, the events of six hours in Brussels last week shows us that the whole of Europe is facing some very long and difficult years ahead.

Source: euobserver.com