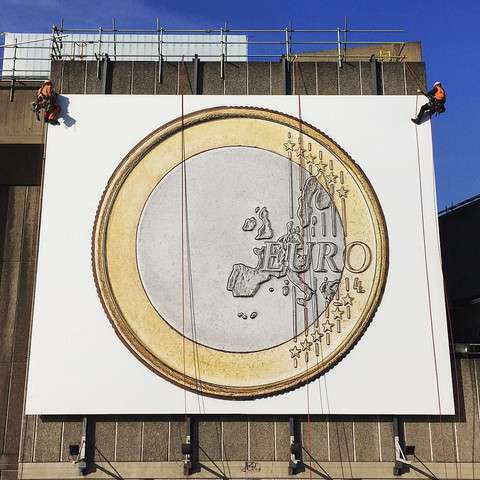

It is really up to Bulgarian politicians to turn the euro into their success story. Unfortunately, the short-term prospects are mixed at best (Photo: Images Money)

EU enlargement is making headlines once more, with Ukraine — yet, unnoticed by many, European integration is expanding its territorial remit in other, equally significant ways.

On 1 January 2023, the eurozone will welcome Croatia as its 20th member. This raises questions about the other candidate, Bulgaria.

-

On 1 January 2023, the eurozone will welcome Croatia as its 20th member. This raises questions about the other candidate, Bulgaria (Photo: Richard Holt)

Once the frontrunner, the Bulgarians lost steam after a turbulent 2021 and three elections. A four-way reformist coalition cobbled together with great effort collapsed after just six months in office, on 22 June. This makes Bulgaria’s target date for joining the eurozone, 1 January 2024, elusive.

Membership in the eurozone should be a no-brainer for a small open economy trading heavily with the EU and reliant on European financial institutions. Thanks to a currency board, Bulgaria has been using the euro, like the Baltic countries, Slovakia and Slovenia back in their day.

Even if the board already underpins, there is room for improvement. Supranational supervision through the ECB and the European Stability Mechanism (ESM) is key for greater transparency and accountability.

Bulgaria has suffered from occasional banking crisis such as the 2014 collapse of the Corporate Commercial Bank (CCB). The largest domestically-owned lender fell prey to insider trading, asset looting and, ultimately, state capture.

Further, improved institutional framework driven by accession to the eurozone will boost international investment, with the ensuing benefits of greater liquidity and technological spillovers.

The eurozone and the EU as a whole will benefit themselves too. Enlarging the monetary union will boost the liquidity and the international reserve currency standing of the euro, while further integrating the economic union.

But to be fair, euro adoption is not problem-free.

There are legitimate concerns about prices (and wages) rising. Yet inflation in Bulgaria is already higher than the one in the eurozone and price convergence has been rapid in recent years. According to economists, the round-up effect on prices to be minimal.

Critics in Sofia point at the fact that Bulgaria would be chipping into the (ESM) and potentially bailing out much richer eurozone members. Yet this argument works the other way as well. ESM will create another safety net for Bulgaria too.

From the perspective of the eurozone, a problem would be taking fiscal responsibility of a country with potentially higher borrowing risks than the eurozone core that could be tempted to borrow beyond its means — a repeat of the Greek sovereign debt crisis. Yet Bulgaria has maintained fiscal discipline for decades.

The most serious objection has to do with the loss of monetary sovereignty.

Yet Bulgaria shed off its monetary sovereignty as far back as the spring of 1997 when it introduced the Currency Board in order to reign in hyperinflation. Since, it has followed by law the German Central Bank and subsequently the ECB. Eurozone membership would therefore be tantamount to regaining some sovereignty through the ability to influence monetary arrangements and reforms rather than following them.

Ultimately, it’s politics

For both Croatia and Bulgaria the ultimate reason to be in the eurozone is actually political.

Being part of the EU’s core in times of uncertainty is essential to upholding national interest and securing longer-term development. A growingly differentiated Union, where members are excluded from privileged clubs, spells trouble for countries which are in the business of catching up with more prosperous and secure societies to the west.

Economic stability and a link to the innovative EU core should also translate into greater political stability. The external threat posed by Russia should only serve to strengthen this motivation. Particularly for Bulgaria which borders both Ukraine and the Russian Federation thanks to the Black Sea.

Geopolitics motivates current members of the Eurogroup too. The European Commission did not make a fuss about Croatia’s debt which stands to nearly 80 percent of GDP (much smaller percentage than Italy or Greece, to be sure).

It is unlikely to take Bulgaria to task about inflation either.

Consistently prudent fiscal policy, despite the recent ramp up of public spending in response to Covid-19, and Vladimir Putin should convince sceptics in Germany or the Netherlands too.

So it is really up to Bulgarian politicians to turn the euro into their success story. Unfortunately, the short-term prospects are mixed at best. The collapse of the Kiril Petkov government, the likely fresh elections, populists trying to score cheap points as defenders of national sovereignty against the ‘diktat of the eurocrats’, might well delay accession to the eurozone even further.

The bottom line, however, is clear: both Bulgaria and the EU as a whole share an economic interest in expanding the boundaries of the common currency.

Source: euobserver.com